Cardiosynergy Market Potential

Cardiotoxicity, the harmful impact of substances like chemotherapy drugs on the heart, is a growing concern due to the rise in cancer survivorship. Despite many years and many more publications, finding effective clinical options to prevent or manage cardiotoxicity is crucial for maintaining heart health and improving the quality of life and survival outcomes for cancer patients. A compound that not only protects the heart from cardiotoxicity but also aids in cancer killing is a unique and valuable approach in cancer treatment. Such a dual-action compound would revolutionize patient care by simultaneously safeguarding cardiovascular health and enhancing the effectiveness of cancer therapies.

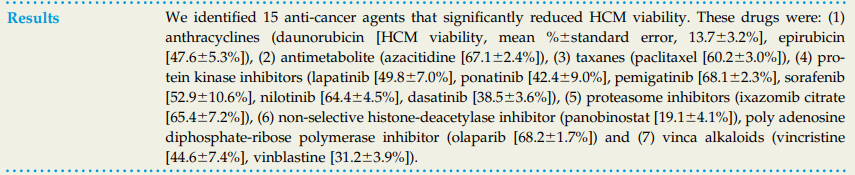

The Doan et al. paper investigated the direct effects of 35 FDA-approved anti-cancer drugs on human cardiomyocyte (HCM) viability; 15 drugs were identified to significantly reduce HCM viability. These included anthracyclines, antimetabolites, taxanes, protein kinase inhibitors, proteasome inhibitors, a non-selective histone-deacetylase inhibitor, a poly ADP-ribose polymerase inhibitor, and vinca alkaloids. The findings suggest that while some drugs have known clinical cardiotoxicity, others may have direct cardiotoxic effects on HCM not previously associated with clinical cardiotoxicity, indicating the need for more detailed investigations to comprehensively understand the mechanisms of cardiotoxicity in cancer therapies.

Bisantrene, recognized as the most potent inhibitor of the fat mass and obesity-associated (FTO) protein, has shown strong clinical success in the treatment of acute myeloid leukemia (AML). FTO overexpression has been linked to numerous different cancer types, while knockdown or inhibition has been shown to kill cancer cells or synergise with other therapies for improved cancer cytotoxicity. Additionally, Bisantrene stands out as a cardioprotective agent, setting it apart from other chemotherapy drugs that often induce cardiotoxicity. While the mechanism of action for cardioprotection is not known, this dual functionality offers a significant advantage in the overall management of cancer patients. The unique combination of potent anti-cancer activity and cardioprotection positions Bisantrene as a valuable candidate for further development and clinical use in oncology.

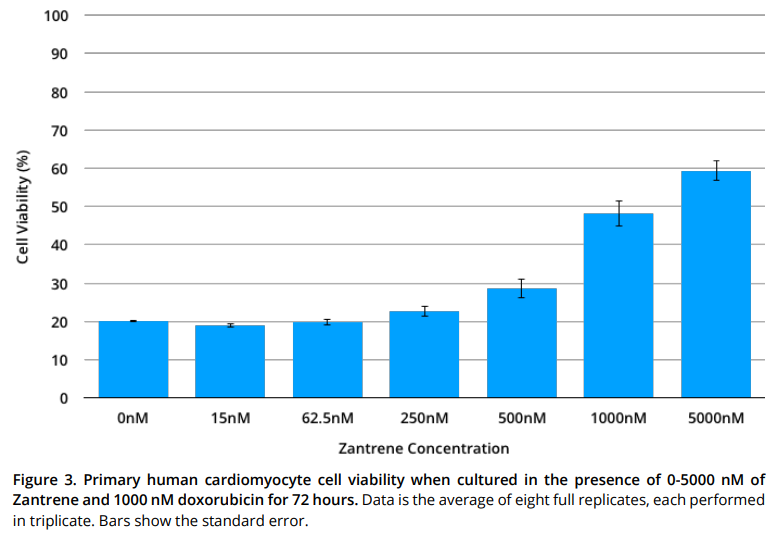

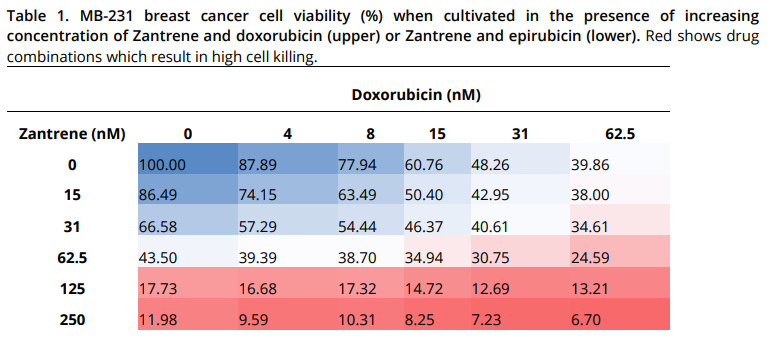

Preclinical studies have shown that Zantrene, a cardioprotective agent, can shield heart cells from the damaging effects of chemotherapy drugs like doxorubicin and carfilzomib, significantly improving their survival. This protective effect is observed even at higher doses of Zantrene that are still within the safe range for human treatment. Importantly, Zantrene not only protects the heart but also enhances the cancer-killing effects of chemotherapy drugs, showing a synergistic effect against various breast cancer cell types, including drug-resistant forms. In a mouse study, Zantrene significantly protected the heart from chemotherapy-induced damage, allowing the use of higher chemotherapy doses without increasing overall toxicity or myelosuppression. This suggests that Zantrene can enhance the efficacy of chemotherapy while protecting against its toxic effects on the body and bone marrow.

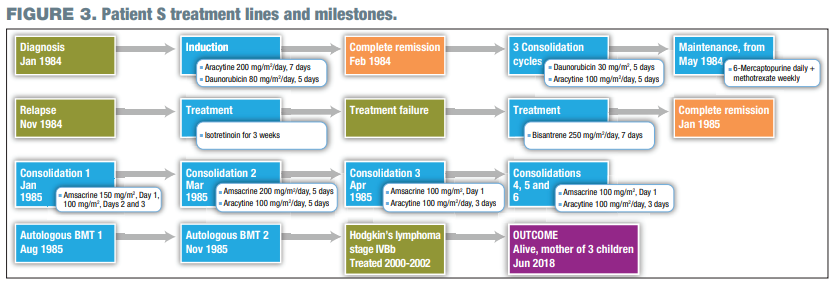

Clinical data further supports Zantrene's potential as a cardioprotective chemotherapy agent. In studies, Bisantrene (Zantrene's active ingredient) combined with aracytine showed a 46% overall response rate in children with refractory and relapsed acute leukemia, with no primary cardiac toxicity observed. In adult metastatic breast cancer patients, Bisantrene demonstrated lower cardiac events and cardiotoxicity compared to doxorubicin and mitoxantrone. Long-term survival case reports of two French women treated with Bisantrene highlight its ability to treat relapsed cancer patients without any reported cardiac events. These findings suggest that Bisantrene offers a safety profile that may reduce the risk of long-term cardiac complications while effectively treating cancer.

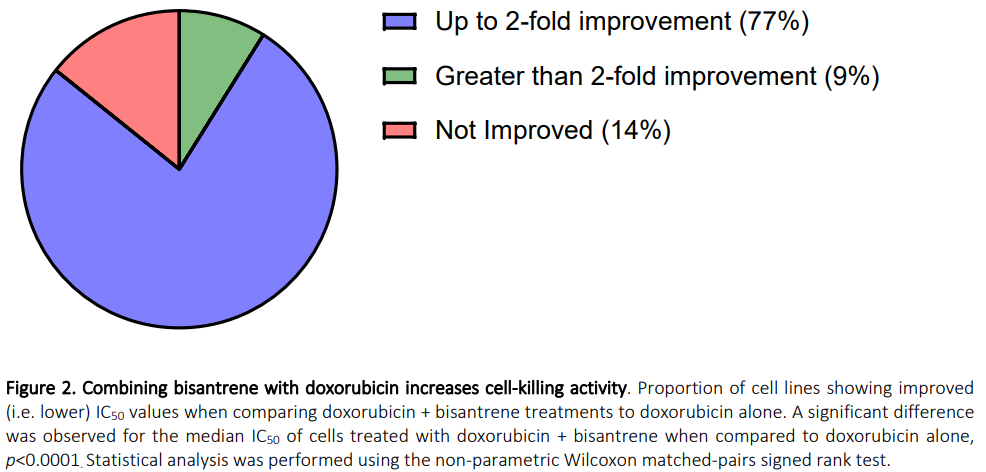

The current pathway RAC is following is taking Bisantrene to trial in combination with Doxorubicin to determine whether there is cardiosynergy. Bisantrene has demonstrated broad anti-cancer activity in a preclinical study, showing potent cell-killing effects in 143 human cancer cell lines, including both blood and solid organ tumors. Notably, when combined with doxorubicin, a widely used anthracycline chemotherapeutic, bisantrene significantly improved cancer cell killing efficacy, with greater cell killing observed in 86% of tumor cells. This suggests that bisantrene could be used in combination with doxorubicin to enhance its anti-cancer effects, potentially offering additional benefits for patients undergoing doxorubicin-containing therapies. These findings support the clinical use of bisantrene in patients where doxorubicin is indicated and highlight its potential to improve treatment outcomes.

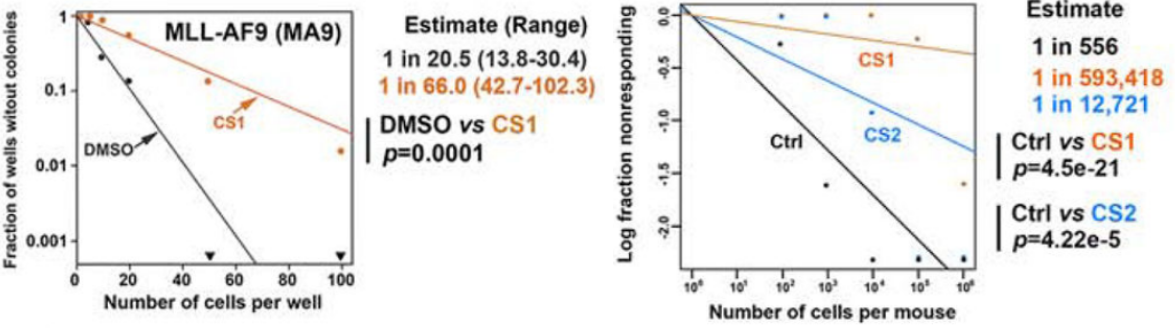

FTO plays a crucial role in regulating cancer stem cells (CSCs), including leukemia stem/initiating cells (LSC/LICs) in acute myeloid leukemia (AML), by modulating RNA methylation, particularly N6-methyladenosine (m6A). This modification affects the stability and expression of oncogenes and tumor suppressor genes, influencing CSC behavior. CSCs, characterized by their unlimited self-renewal potential, are often resistant to conventional therapies and are responsible for tumor recurrence and metastasis. Targeting FTO offers a promising strategy for eradicating these resilient cells. Pharmacological inhibition of FTO with bisantrene (CS1) has been shown to induce apoptosis, cell cycle arrest, and promote myeloid differentiation in AML cells. Importantly, bisantrene effectively reduces the frequency of LSC/LICs in murine AML models, highlighting its potential in disrupting the maintenance and survival of CSCs.

The following is a combination of the Doan et al data with the synergy data that I have collected over the last 4-years following RAC. Of the 16 drug classes included into the study that were identified to cause cardiotoxicity of any kind, FTO knockdown/inhibition has been shown to synergise for improved cancer killing properties in 10 (62.5%). More specifically, evidence supports FTO knockdown/inhibition synergy with 7/9 (77.8%) of drug classes shown to induce a significant (>30%) reduction in HCM viability (72 hours), while there were 7/11 (63.6%) synergies with drug classes shown to induce a non-significant (<30%) reduction in HCM viability (72 hours). There is variability in numbers because some drug classes have drugs that confer both significant and non-significant cardiotoxicity.

When I put this information together with the risk mitigation of clinical history for cardioprotection and efficacy, I only see an enormous opportunity. The Triangle Insight Report states that Cardiosynergy with doxorubicin could reach overall peak commercial value from approximately $1.7 billion USD within breast cancer alone in the US to $5-8 billion USD globally if expanded into additional indications and approved in ex-US markets. While this would truly be game changing - if Cardiosynergy is proven in doxorubicin, a new drug class will be established and headlined by Bisantrene, and I believe there will be rapid investigation into any of the other cardiotoxic drug classes demonstrating synergy with FTO inhibitors. In truth, I do not know how to value a molecule like Bisantrene, but I see a lot of shots on the board.

(20min delay)

(20min delay)