...no wonder I am observing Gold and Silver going up after US session begins. Gold and Silver goes up during China's trading session as well.

...the only period they fall is during Europe's opening session, which means EU is selling (no surprise, recall it was UK's David Brown that sold his country's gold war chest years ago, a colossal mistake).

...$2300 and $28 are early days for Gold and Silver !!!

BofA says gold and silver remain cheap as they snap up 4.4 tonne of gold and 3.1 million oz of silver.

That's a change of direction on gold

MICHAEL LYNCH ON GOLD & SILVER

APR 16, 2024

BofA re-entered the physical gold and silver market over the last 3 days.

First gold … BofA bought 142,000 oz or 4.4 tonne yesterday (April 15).

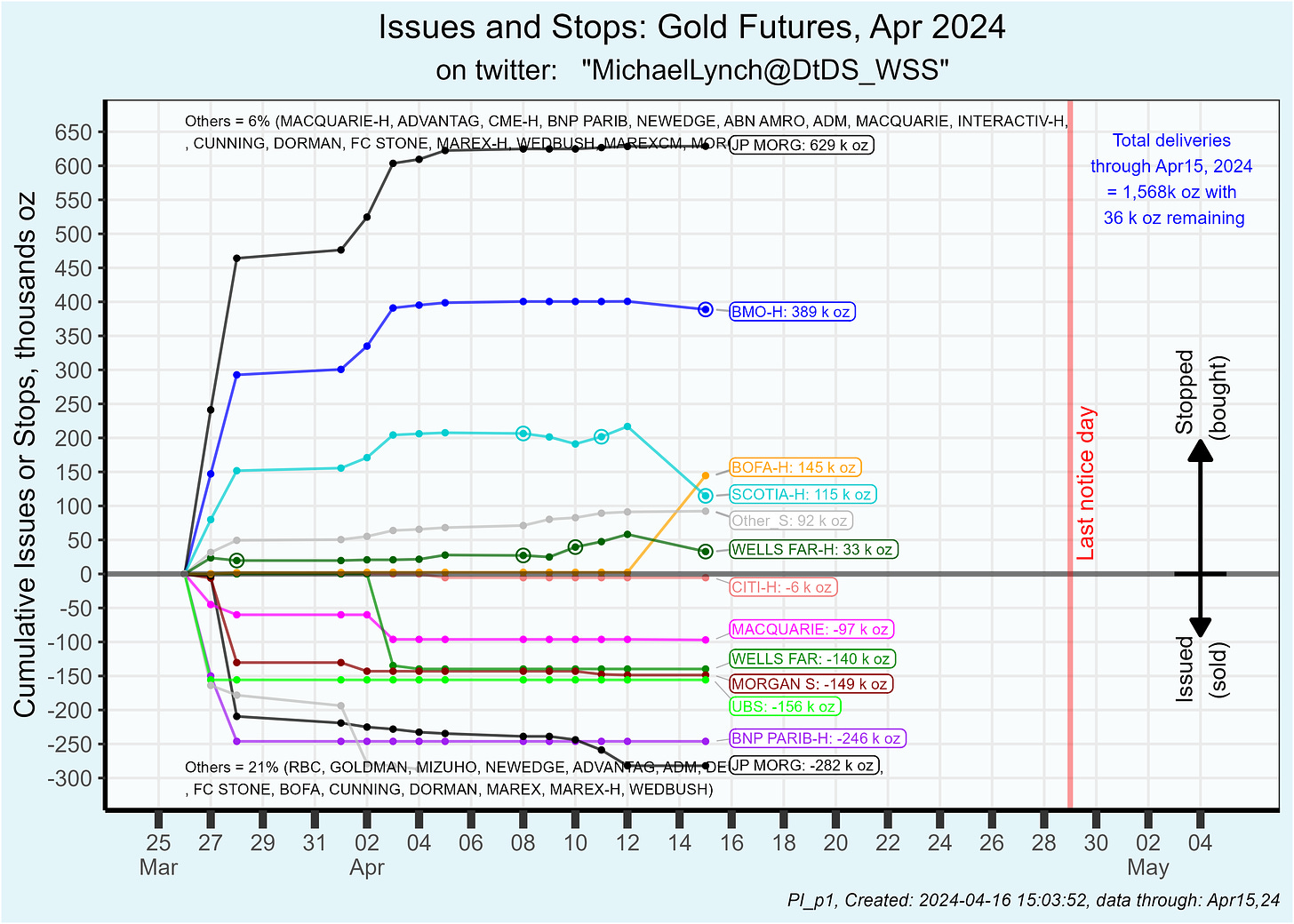

Total volume on the April contract was 1,801 resulting in 1,446 new contracts.

Delivery notices were issued for 1,436 and BofA stopped nearly all of them … 1,422.

The net of that is that BofA was the prime mover on the April contract and, most importantly, they are snapping up gold north of 2,300/oz.

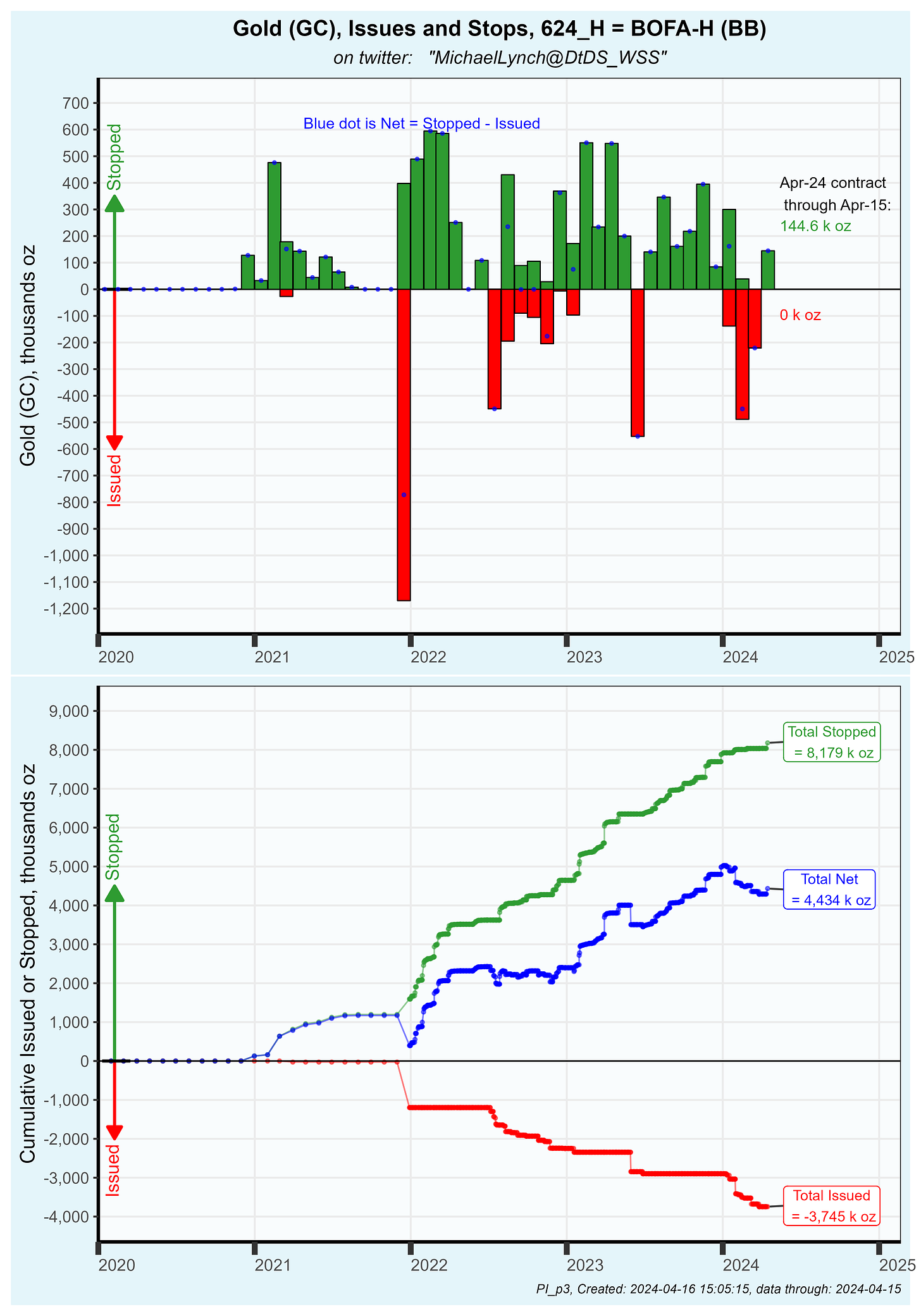

Recall that BofA was on a gold buying binge from July of last year through January of this year and then sold gold from mid January through March. This 4.4 tonne purchase is therefore an about face on BofA’s gold direction. See the plot below of each contract’s issues and stops:

The sellers were mostly Scotia and Wells Fargo. Both of those banks routinely trade metal during the delivery period so those sales are less meaningful as they are routine trades.

Cumulative issues and stops for the April contract is below:

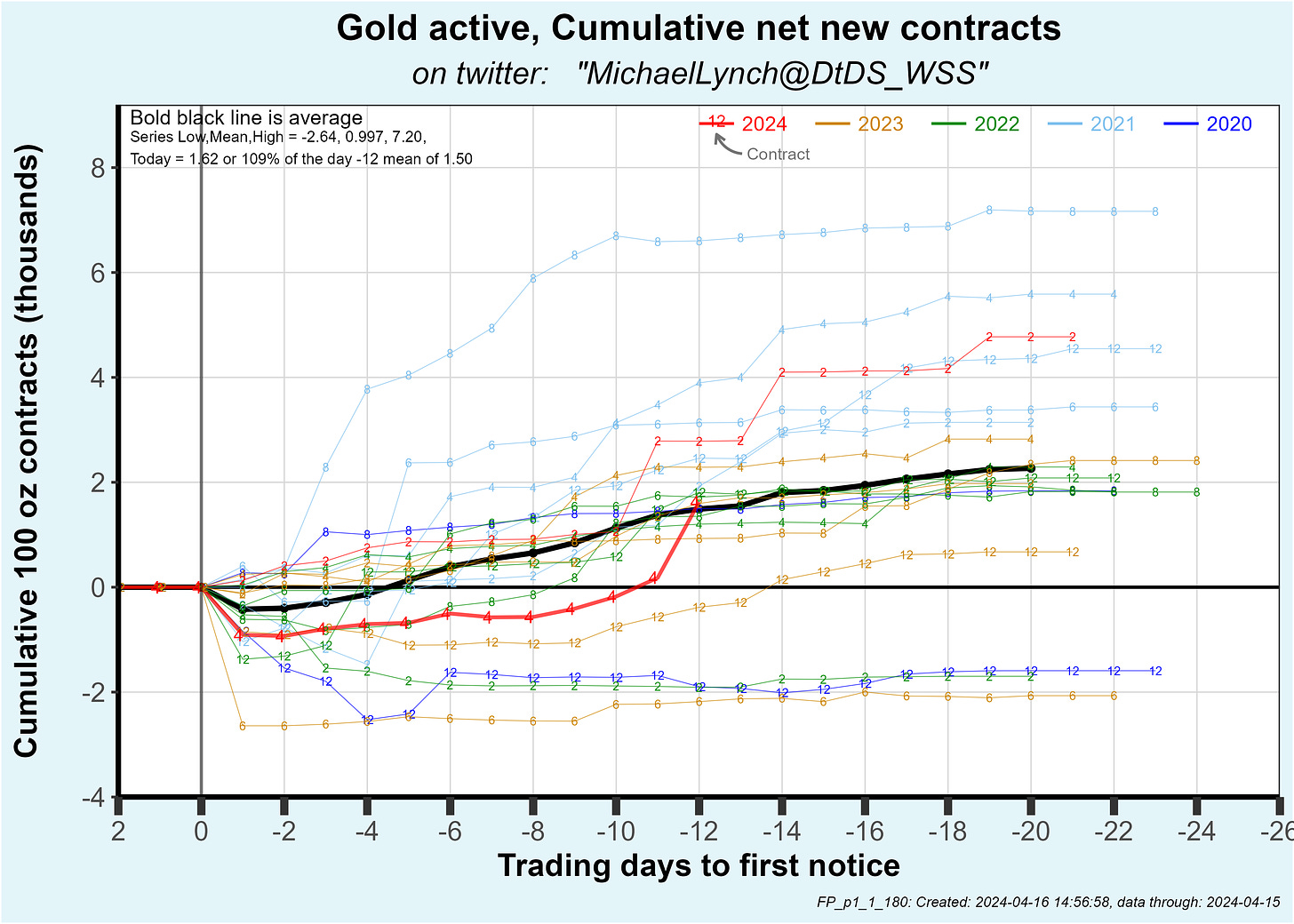

Despite this mid delivery period surge of new contracts, there hasn’t been a rush for physical gold as prices have spiked. Cumulative net new contracts is only average:

+++++++++++++++ Silver

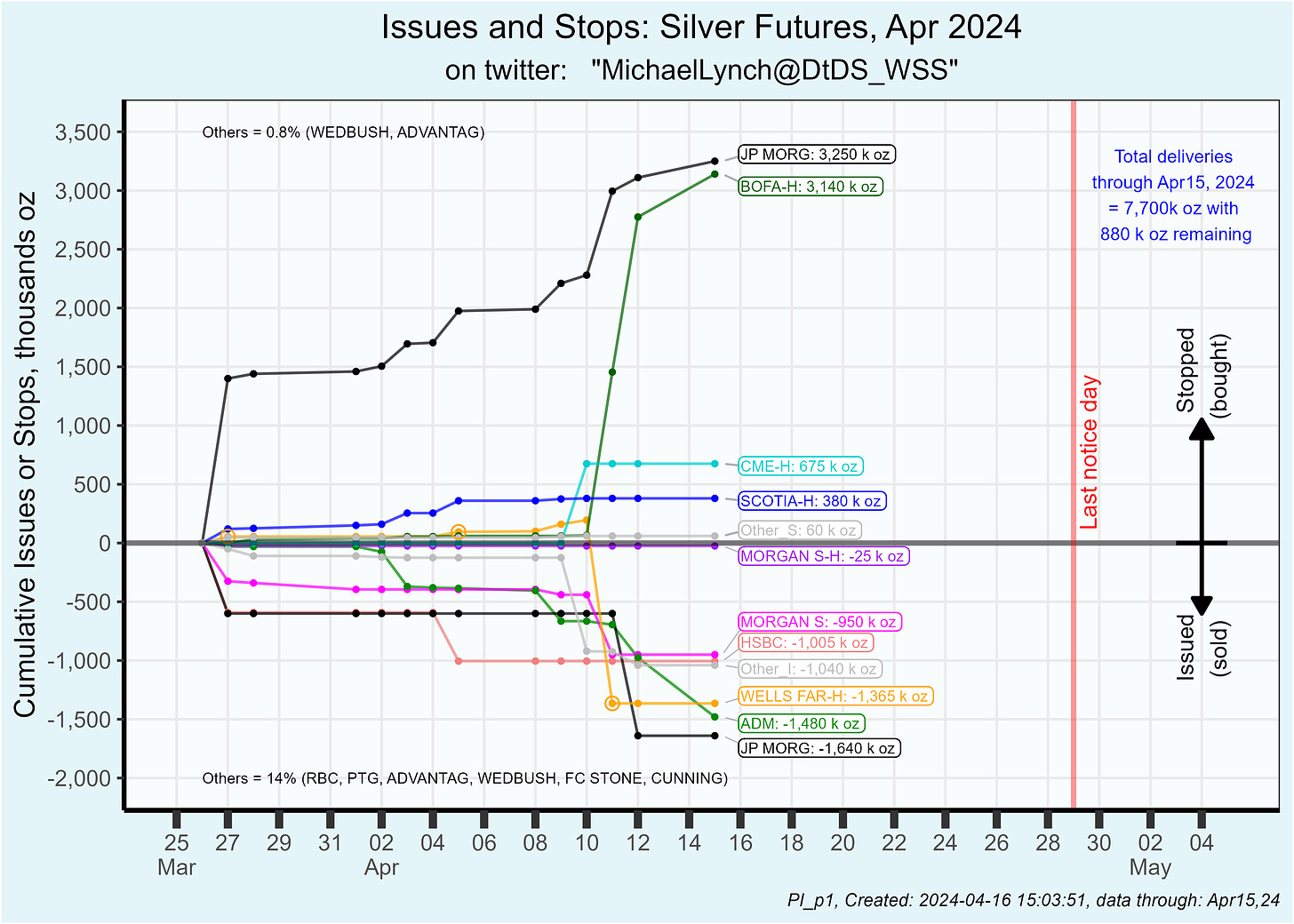

BofA also re-entered the silver market and bought a total of 3.1 million oz of silver on April 11, 12 and 15. Prior to that they had only bought 65,000 oz on the April contract which, by BofA standards, is essentially zero. The take away is … silver prices over $28 remain a good buy for the biggest comex player.

BofA has been on a silver buying binge since July of last year interrupted only by bail outs of other players:

This 3 day binge buy launches BofA into their usual position near the top of silver buyers:

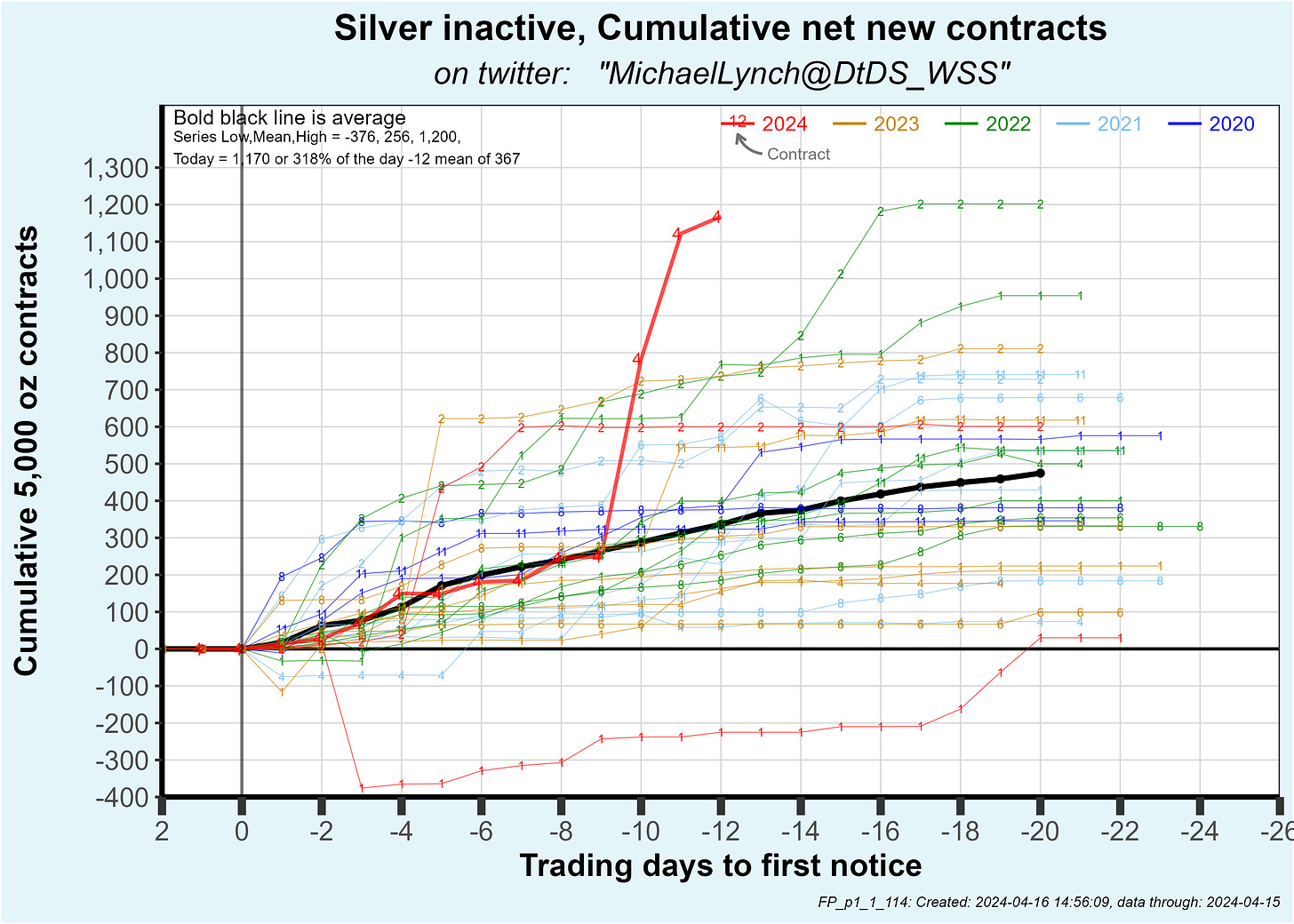

Prior to BofA’s binge on the April contract, the cumulative new contracts was average. However the April contract is now nearly the highest of all inactive contracts over the last 4 years. Two weeks remain on the contract so there may be more fireworks ahead:

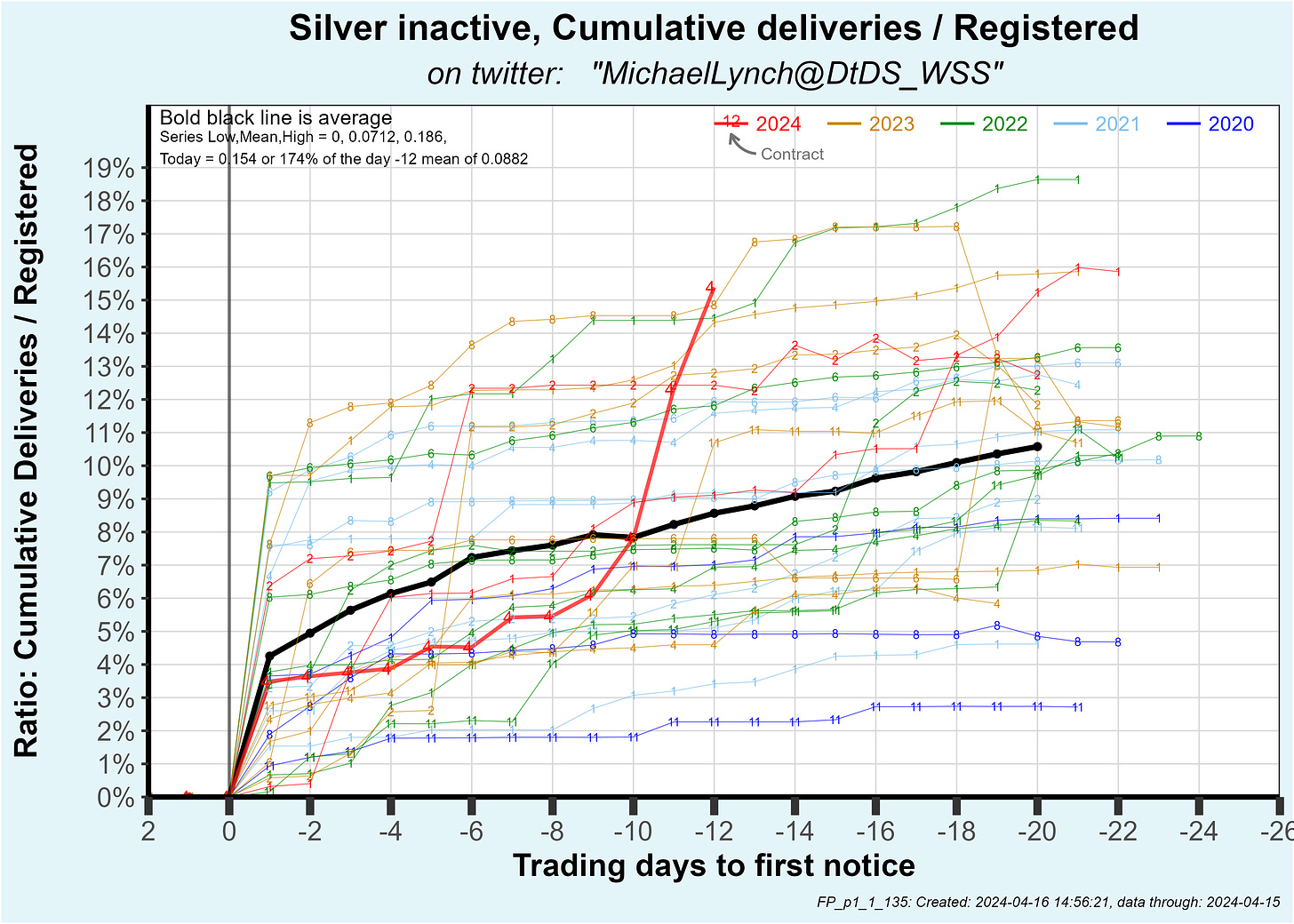

Cumulative deliveries to date are now 15% of registered … one of the highest for an inactive month:

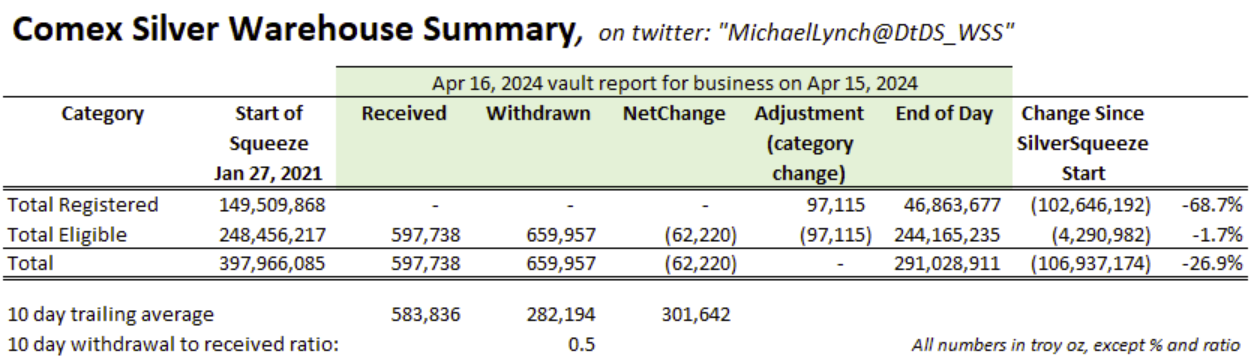

+++++++++++++ Silver Vaults

One truckload arrived at Asahi and 660 koz departed at CNT:

+++++++++++++ Gold Vaults

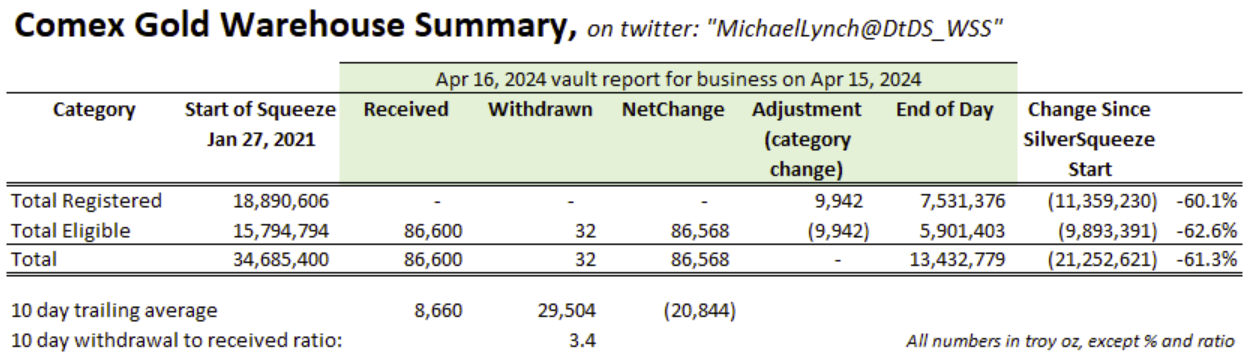

There was a 86.6 koz deposit at HSBC’s vault which is the third largest deposit over the last 3 quarters:

The gold numbers to the oz:

- Forums

- ASX - General

- Its Over

...no wonder I am observing Gold and Silver going up after US...

- There are more pages in this discussion • 270 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)