...what a wild day overnight at Wall St

...while holding rates steady, Powell surprised the markets with a QT taper from June as yields are too high, proceeding to continue saying that inflation remains high and that more patience is needed. When pressed on rate hikes, he left the door open on that while indicating it is "unlikely", that the next move is unlikely to be a rate hike, while indicating that he has no timeframe how long rates can stay higher

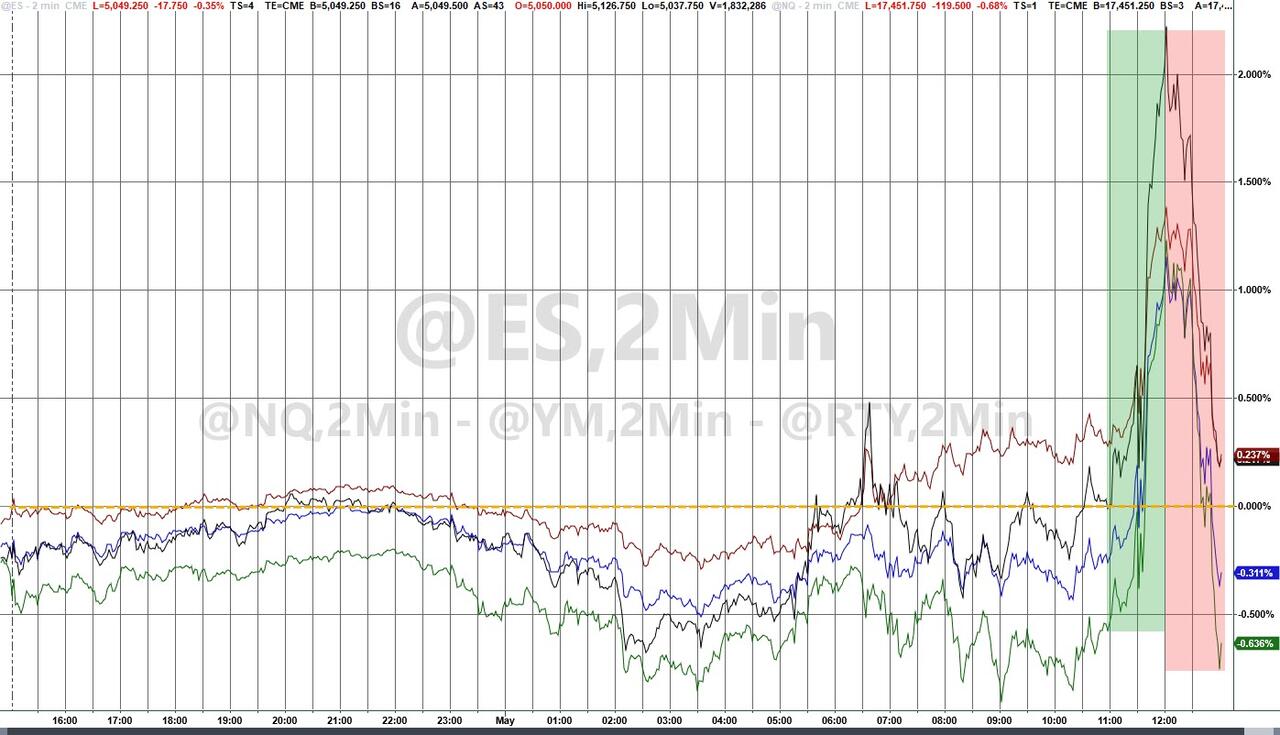

....the markets loved it as Powell was obviously more dovish when they were expecting hawkishness, the result of which saw Dow gaining an intra day high of 530pts and the S&P500 up more than 1%. But as soon as the Fed presser ended, the last hour saw a wild move that wiped out all the gains on the S&P causing to close -0.34% lower on the day at 5018 and the Dow ended with just +87pts gain, Nasdaq -0.33%

https://x.com/Schuldensuehner/status/1785763591028666723

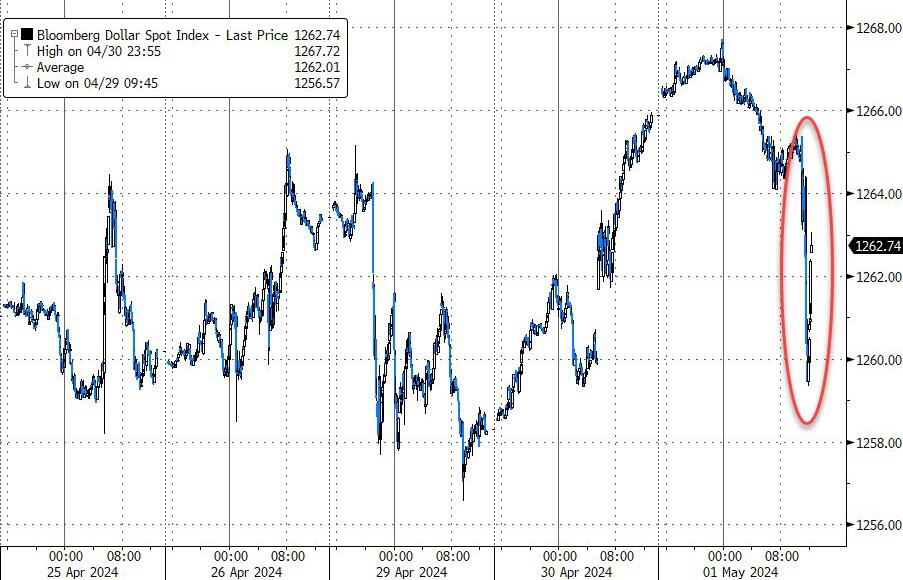

....US 2 yr broke below 5pc to 4.92pc before late recovery t0 4.97pc , US 10yr ended at 4.63pc; the DXY was slammed down to 105.43 before recovering to above 106 only to experience another slam to 105.69 on suspicion that BoJ intervened for a second time. That took the dollar down 2yen in an instant.

https://x.com/KobeissiLetter/status/1785777512041050150

...NVIDIA lost -3.93%, Tesla -1.79%, AMD -8.95%, SMCI -14.03%, Meta 2.08%, MSFT +1.49%, AAPL -0.6%, Amazon +2.21% while Starbucks and Norwegian Cruise sunk -15.88% and -14.96% respectively, reflecting a mix bag amongst the heavyweights but in big directional moves

https://x.com/unusual_whales/status/1785761095854280807

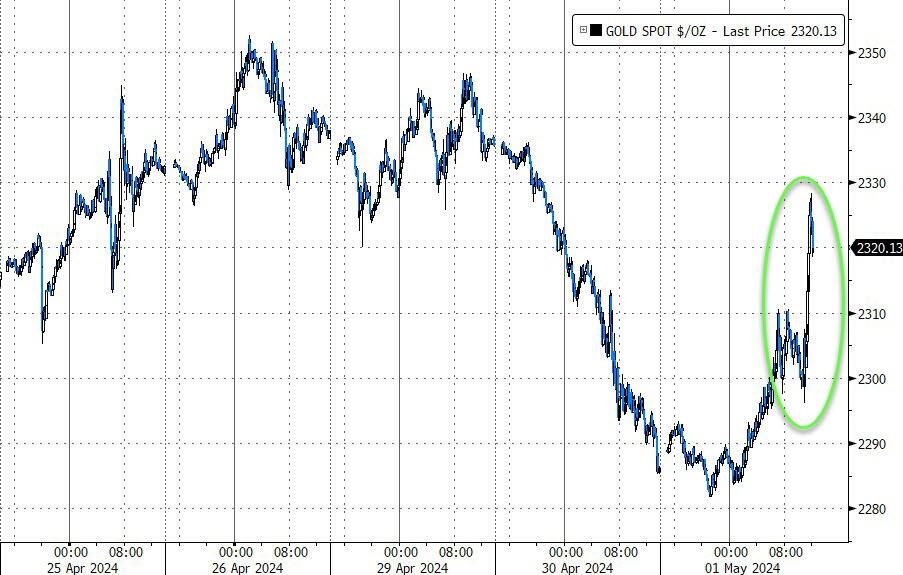

...Gold was a beneficiary of the QT taper news and pushed to $2328 before tapering to $2319, likewise GDX and GDXJ gave up earlier +2% gains to close modestly higher at +0.57% and +0.77% respectively

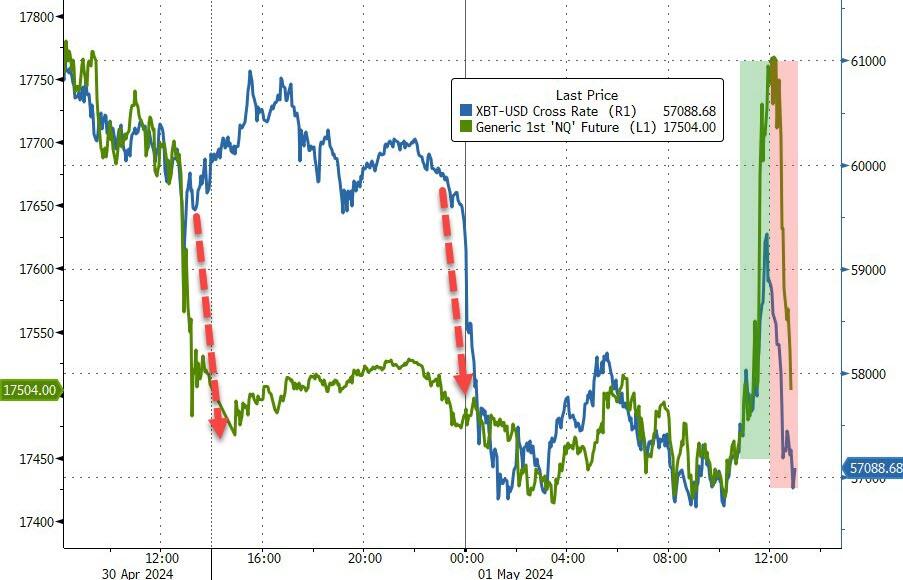

...BTC remains under pressure at $57-58k level

...Oil and coal stocks were big losers, WTI Crude fell -2.94% to $78.7 on higher US inventory, oil stocks broadly lower, XLE -1.59%, coal stocks BTU -2.3%, AMR -1.42%, ARCH -1.22%

...Lithium stocks see sawed but ended mixed to slightly lower: LIT +0.55%, ALB -1.09%, SQM +0.31%, LAC -1.25%, PLL -1.22%. In after hours earnings release, ALB at -0.91% after quarter EPS at 26c beating estimates by 2c with revenues at $1.36B against $1.28B consensus, however a big fall from earlier quarter of revenue $2.36B and EPS of $1.85.

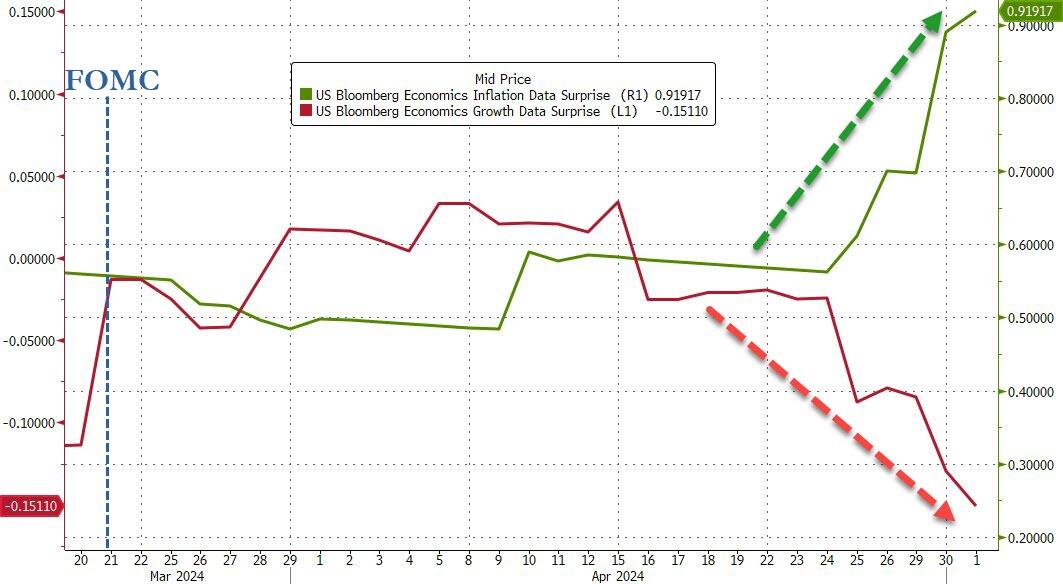

...now the bond market expects just 1 rate cut in November 24.

Taper 'Tantrum-ette' - Stocks Pump'n'Dump As Fed 'Eases' Balance-Sheet Pressure

BY Zero Hedge

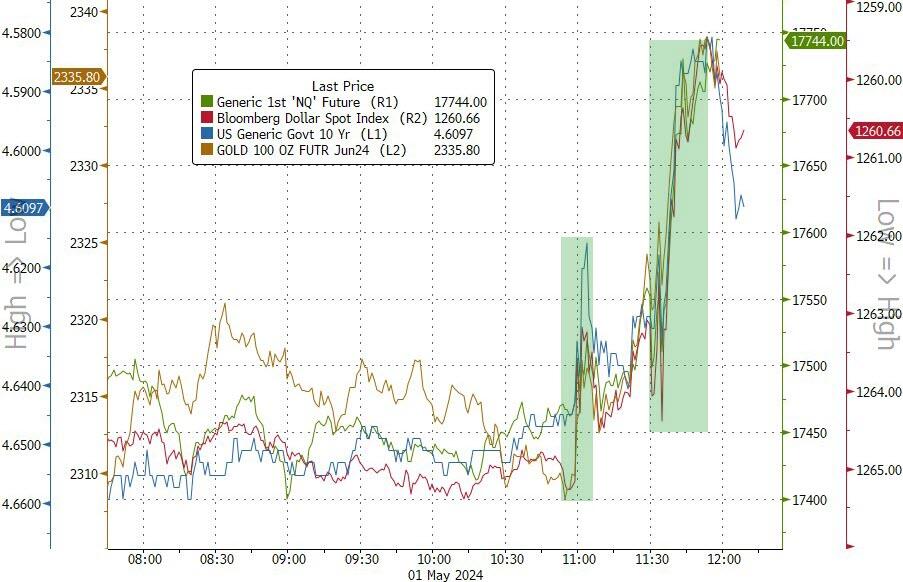

The bigger than expected QT taper announcement juiced markets (stocks and bond prices up, dollar down) into Powell's press conference, then got spooked lower as he admitted "inflation has shown a lack of further progress... and gaining confidence to cut will take longer than thought."

But that dip didn't last long and yields puked, stocks soared, gold rallied and the dollar puked...

Source: Bloomberg

The market shrugged off Powell's comments about "whether rates are at their peak will depend on data" which opened up the path of possible rate-hikes, but he dd add that "he doubts next move will be a hike."

CNBC's Steve Liesman asked the big question that everyone should be asking: you are 'sort of easing' by reducing QT while holding rates flat because you're not confident that inflation is under control - wassup with dat?

Powell replied with some words that meant nothing, stating that they have long planned on tapering QT and claimed that 'reduction in balance sheet run-off is not policy-easing'.

"This is not the easing you're looking for..."

By the close, all of Powell's pig-kissing lipstick had been wiped off (see below for the coordinated crypto/nasdaq take-down) as stocks saw solid gains erased in the hour after Powell stopped speaking... Small Caps and The Dow managed to hold on to the gains but Nasdaq and S&P closed nearer the day's lows...

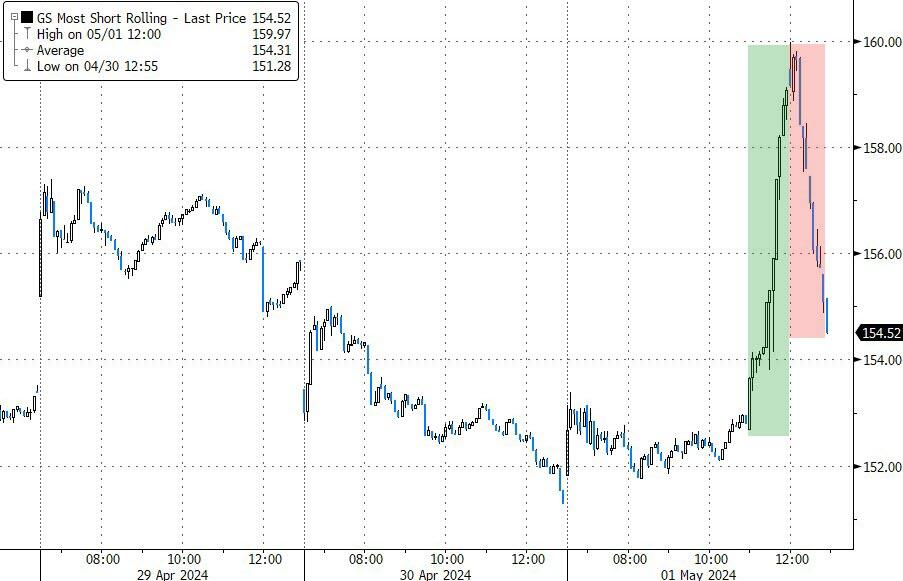

'Most Shorted' stocks saw a massive squeeze (+5%) on the FOMC headlines, before the late day selling pressure hit...

Source: Bloomberg

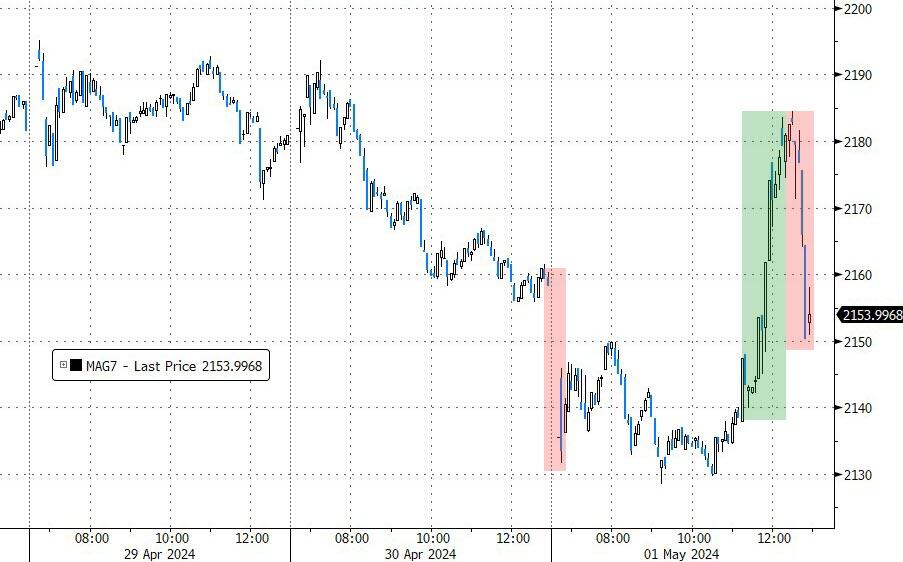

MAG7 stocks ended the day unchanged after giving back their post-Powell gains...

Source: Bloomberg

Treasury yields plunged 6-8bps across the curve on the day, with the short-end outperforming, dragging all yields lower on the week...

Source: Bloomberg

The 2Y Yield snapped back below 5.00% once again...

Source: Bloomberg

The yield curve (2s30s) jerked flatter initially, then steepened dramatically back to flat on the week...

Source: Bloomberg

The dollar tumbled on the non-easing 'easing' (but bounced back a bit after Powell finished speaking)...

Source: Bloomberg

Gold surged back above $2300 on the non-easing...

Source: Bloomberg

Bitcoin bounced back on the FOMC statement, recovering some of last night's bloodbathery, but somebody did not want it back to $60,000 and that smackdown dragged stocks down with it...

Source: Bloomberg

Oil prices ignored all the fuss around The Fed and fell for the third day in a row (its biggest daily drop since early Jan) with WTI back below $80 at six-week lows...

Source: Bloomberg

Finally, rate-cut expectations (hawkishly) rose on the day with one-or-two cuts in 2024 now 50-50 and two-or-three cuts more in 2025 around 50-50 also...

Source: Bloomberg

And, also Powell explained that he "doesn't see the stag or the 'flation" in markets... well this should help Jay...

Source: Bloomberg

We can't help but feel like Powell is awfully eager to 'loosen' policy... but he made it clear that the 2024 election "just isn't a part of the Fed's thinking."

So, that's that then!

- Forums

- ASX - General

- Its Over

...what a wild day overnight at Wall St ...while holding rates...

- There are more pages in this discussion • 348 more messages in this thread...

You’re viewing a single post only. To view the entire thread just sign in or Join Now (FREE)

Featured News

Featured News

The Watchlist

RDN

RAIDEN RESOURCES LIMITED

Dusko Ljubojevic, MD

Dusko Ljubojevic

MD

SPONSORED BY The Market Online